Amtrak to STB: Deny CN’s Responsive Application

Prepared by

Marybeth Luczak, Executive Editor

Amtrak is contacting on the Area Transportation Board (STB) to deny CN’s problems to the Canadian Pacific-Kansas Town Southern merger due to the fact they do “not satisfy the Board’s ‘operationally feasible’ requirement” and “would hurt the community desire by adversely impacting the provision of passenger rail company. …”

The STB on July 1 recognized for consideration responsive purposes by CN and Norfolk Southern (NS) about the CP-KCS combination, which is less than STB critique and seeks to build North America’s to start with transnational freight railroad, Canadian Pacific Kansas Town (CPKC).

CP and KCS in September 2021 agreed to combine STB in November 2021 acknowledged their application to variety CPKC.

CP and KCS on May perhaps 13, 2022, submitted a revised working plan as ordered by STB, and CN and NS on June 9 submitted amended responses, with each and every railroad requesting a variety of disorders, such as divestiture of the Springfield Line in Illinois and Missouri as effectively as certain trackage rights.

CN and its U.S. subsidiary Illinois Central Railroad Firm (ICRR) request, as a affliction to any approval of the CP-KCS merger, acceptance of the sale of KCS’s line between Kansas Metropolis, Mo., and Springfield and East St. Louis, Sick., to ICRR.

“In connection with the line acquisition, ICRR also seeks acquisition of an 8.33% ownership share of Kansas Metropolis Terminal Railway Corporation (KCT), which would help ICRR to operate over KCT-controlled trackage in Kansas City, and a 50% possession desire in KCS’s International Freight Gateway terminal (IFG Terminal) south of Kansas Town,” among other circumstances, in accordance to the STB.

Amtrak disputed these conditions in a July 12 filing to the STB (obtain under).

Amtrak wrote it “respectfully requests that the Board deny” CN’s responsive software because the Course I railroad would run supplemental freight trains over:

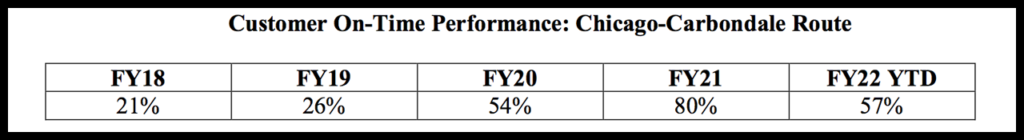

• CN’s Homewood (Chicago), Unwell., to Gilman, Sick., line (the approximately 57.6-mile Homewood-Gilman Line Section), “on which CN has regularly represented to the Board that it does not have adequate potential to accommodate even present Amtrak and CN functions.” CN is envisioned to function two extra freight trains in this article and on a brief segment in Memphis, Tenn. 6 everyday Amtrak trains function in excess of the CN line between Chicago and Carbondale: the Town of New Orleans, a extensive-distance practice that makes a day by day spherical-vacation concerning Chicago and New Orleans, La., and the Illini/Saluki, point out-supported trains funded generally by the point out of Illinois that give two daily round-outings (together with the 1 presently suspended) together the Chicago-Carbondale corridor.

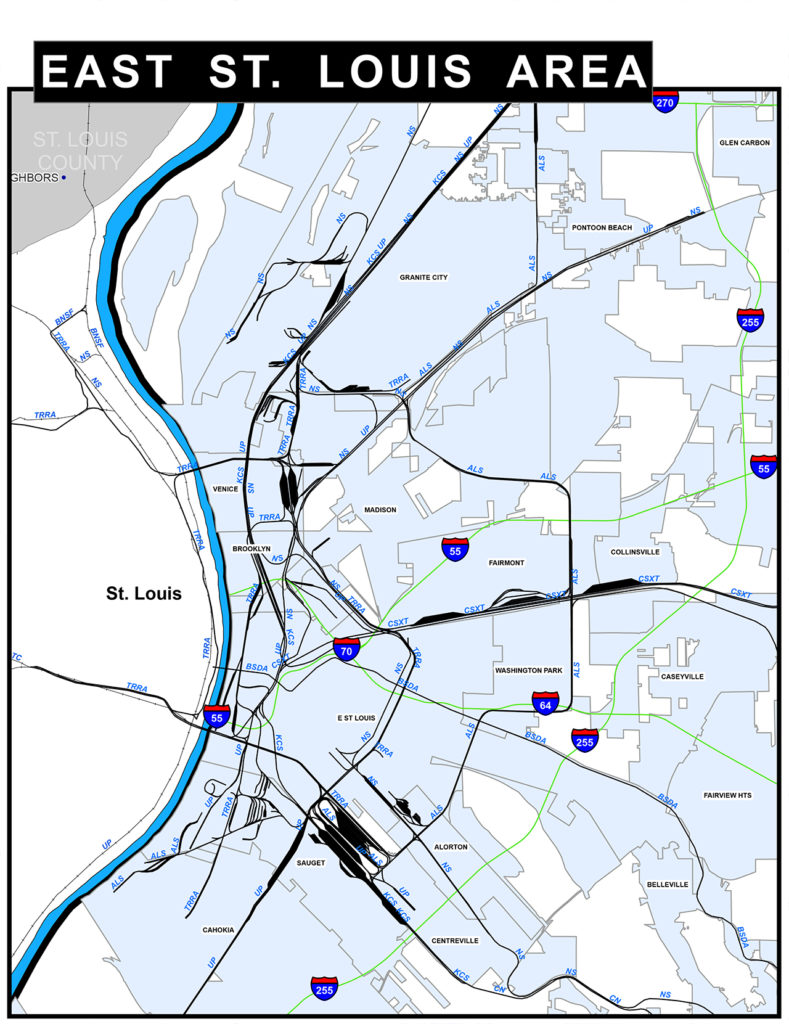

• The rail line jointly owned by KCS and its affiliate marketers and Union Pacific (UP) amongst East St. Louis, Ill., and Godfrey, Unwell. (the around 28.8-mile East St. Louis-Godfrey Line Phase, which is component of the Springfield Line), “on which Amtrak trains currently expertise superior stages of freight teach interference.” CN is slated to work 2.6 supplemental day-to-day freight trains in this article. The East St. Louis-Godfrey Line Phase is component of Amtrak’s Chicago-to-St. Louis Corridor. Ten Amtrak trains work below each day: 4 every day condition-supported Lincoln Provider round-visits between Chicago and St. Louis that are funded mainly by the state of Illinois and the Texas Eagle, a long-distance prepare that operates a day by day spherical-excursion in between Chicago, St. Louis and San Antonio, Tex., with connecting by way of-autos continuing to Los Angeles a few days per week on Amtrak’s Sunset Constrained.

Amtrak also pointed out that it operates more than 6 added rail traces on which there would be much more freight trains and/or more time freight trains if CN’s responsive software were permitted:

• An roughly 250-mile portion of CN’s Chicago-New Orleans major line, and three CN lines in Michigan, on which CN would operate for a longer period freight trains.

• A shorter section on UP in Kansas Town on which CN seeks assignment of KCS’s trackage legal rights and would run 1.7 additional every day trains.

• A short segment on UP in Springfield, Unwell., on which CN has trackage legal rights and would run two extra everyday freight trains.

“CN’s responsive application can make no point out of the current general performance of Amtrak trains functioning above these traces,” Amtrak noted in the STB filing. “It provides no information (other than pre- and submit-transaction prepare density and tonnage figures) that bears upon their capacity and how current rail operations, and in distinct the on-time effectiveness of Amtrak trains, would be impacted if the responsive software is authorized. Though CN has committed to devote at minimum $250 million for cash advancements on other rail line segments on which freight website traffic will boost if its responsive application is granted … , CN has no strategies to make any investments to increase capacity on any of the strains in excess of which Amtrak operates—and apparently has not even assessed no matter whether investments are vital.”

Amtrak argued that “[a]s the Board stated in its [July 1] decision accepting CN’s responsive application, the crucial difficulty when the Board is asked to impose problems on acceptance of a railroad control transaction under 49 USC §11324(c) is whether the disorders ‘would or would not be in the public desire.’ Determination No. 20, served June 30, 2022 at p. 7. Disorders imposed by the Board on its acceptance of railroad mergers ‘must be operationally possible, and develop web public rewards.’ Canadian National Ry., Grand Trunk Corp., and Grand Trunk Western R.R.-Handle-Illinois Central Corp., Illinois Central R.R., Chicago, Central and Pacific R.R. and Cedar River R.R., 4 S.T.B. 122, 141 (1999). Even when the need for a condition is determined, the Board disfavors problems that demand divestitures. ‘We have usually mentioned that divestiture is an excessive solution not to be imposed frivolously[.]’ Id. at 157. Because the additional CN coach functions on the Homewood-Gilman and East St. Louis-Godfrey Line segments that would outcome from acceptance of the responsive application could not be accommodated with no materially worsening the on-time general performance of Amtrak trains functioning over those people strains, the divestiture problem fails to satisfy the Board’s expectations.”

In associated developments, last month Bob Knief, President of Bartlett Grain Co., LP, a U.S. exporter of grain to Mexico, urged the STB to approve the CP-KCS merger and reject CN’s ask for that KCS’s Springfield Line be divested to it. Amid Bartlett’s amenities is a grain facility in Jacksonville, Ill., which Bartlett put in more than $25 million in 2012 to build. The facility, which features a 7,000-foot-prolonged rail loop and can keep up to 100 railcars, opened in August 2013 and is located on the KCS Springfield Line. Sizeable more investments have been designed in Jacksonville since 2013 to expand capacity, in accordance to Bartlett.

Also, Amtrak in May asked the STB to set phrases and ailments for a new working arrangement (OA) in between Amtrak and CN. CN submitted its possess submitting also calling for a new OA, but not on the conditions that Amtrak asked for.

In March, Amtrak issued a 2021 Host Railroad Report Card, ranking the Course I railroads for trying to keep Amtrak intercity passenger trains on time. The Federal Railroad Administration’s “Metrics and Standards” rule, produced in November 2020, needs Amtrak and the host freight railroads to certify Amtrak schedules, and sets an on-time performance (OTP) least normal of 80% for any two consecutive calendar quarters. Each CP and CN acquired an “A” (CN’s Quebec functions are excluded) BNSF gained a “B+” CSX, “B” Union Pacific, “C+” and Norfolk Southern, “D-.” (Kansas Metropolis Southern does not currently host Amtrak services.)

Lastly, in January Amtrak CEO Stephen Gardner introduced “CP’s dedication to [Amtrak’s] initiatives with states and other individuals to increase Amtrak company,” and that the two railroads had achieved an “agreement formalizing CP’s support of Amtrak growth in the Midwest and the South.” He also noted at that time: “Given CP’s consistent file as an Amtrak host, we are supporting CP’s proposal to grow its network” in a merger with KCS.